State Tax Nexus: What Every SaaS Founder and Tech Entrepreneur Needs to Know in 2026

A plain-English guide to understanding when your business owes taxes in other states—and why software companies need to pay extra attention.

Why This Matters More Than Ever in the AI Era

We’re in the middle of an unprecedented SaaS boom. AI tools have dramatically lowered the barrier to building and launching software products. Solo founders are shipping products in weeks that would have taken teams months just a few years ago. Micro-SaaS, AI wrappers, vertical software—new companies are being born every day.

Here’s the problem: the tax code hasn’t gotten any simpler.

I’ve watched founders go from “side project” to “$15K MRR” in a matter of months, only to realize they’ve been unknowingly accumulating tax obligations in a dozen states. The speed at which AI-powered products can scale means you can cross nexus thresholds before you’ve even thought about compliance infrastructure.

If you’re building in the AI era, tax compliance isn’t a “Series A problem” anymore—it’s a “first $100K in revenue” problem. And in many states, that threshold is per state, not total.

The One Sentence Summary

If your business sells to customers in other states (even 100% online), you probably owe sales tax, income tax, or both in those states—and the rules hit SaaS and service businesses harder than you think.

What is “Nexus” and Why Should You Care?

Think of nexus as the legal tripwire that, once crossed, means a state can require you to:

- Collect and remit sales tax on sales to customers in that state

- File income tax returns and potentially pay state income tax

- Withhold payroll taxes if you have employees working there

The problem? There are 45+ states with sales tax, each with different rules. Cross the line in enough states without knowing it, and you could face back taxes, penalties, and interest going back years.

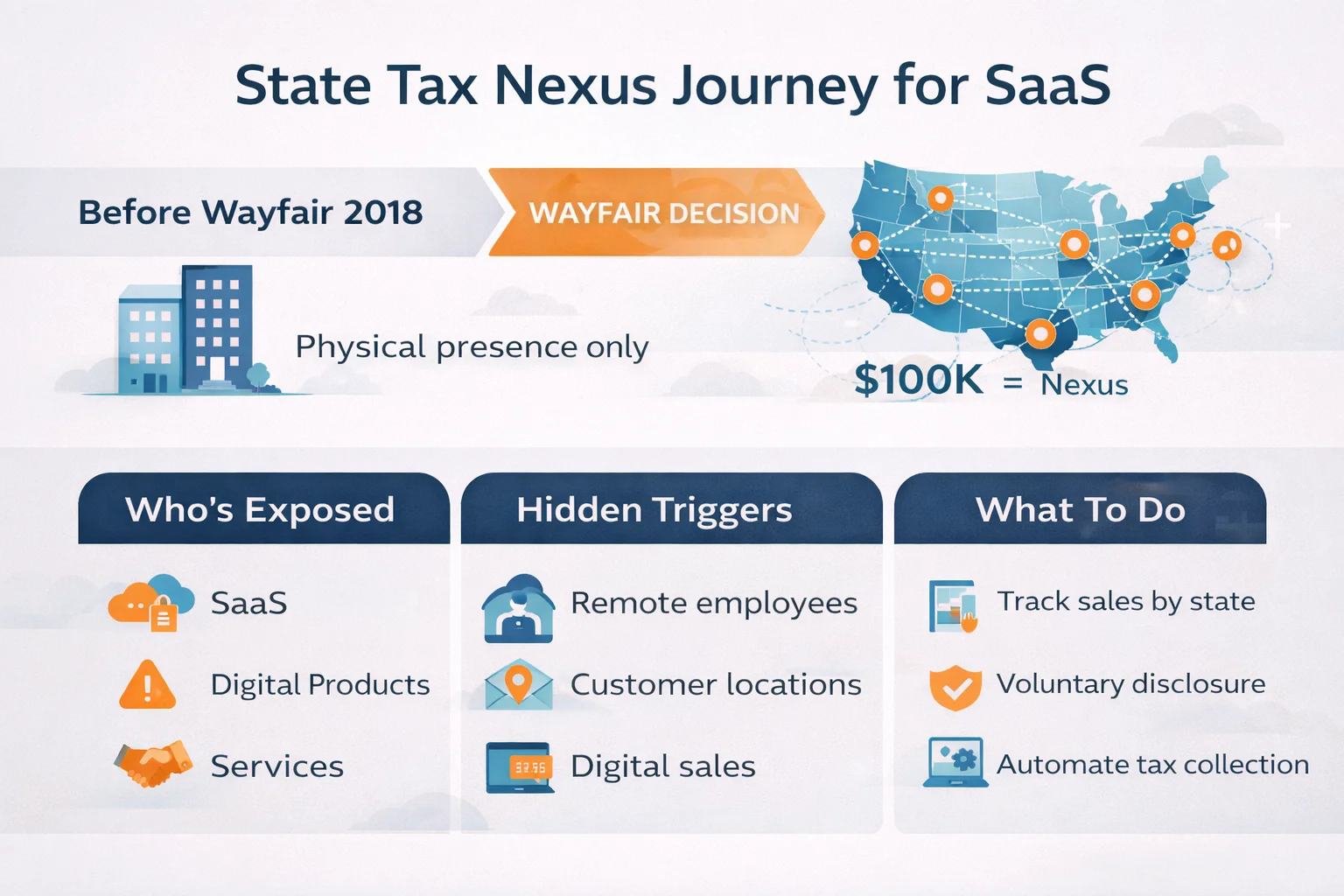

The Game Changed in 2018: The Wayfair Decision

Before 2018, the rule was simple: no physical presence = no tax obligation. You could sell to customers in Texas all day from your Louisiana office, and Texas couldn’t touch you.

Then came South Dakota v. Wayfair (2018), and everything changed.

The New Reality

States can now require you to collect sales tax based on economic activity alone—no physical presence needed. This is called economic nexus.

The common threshold: If you have more than $100,000 in sales OR 200 transactions in a state during a year, you likely have nexus there.

Key Point: Some states only use the $100,000 threshold (no transaction count). Others have lower thresholds. You need to check each state.

Why SaaS and Service Businesses Are Hit Hardest

This is the part that catches most tech founders off guard—and frankly, it’s the reason I wrote this article.

There’s a federal law called P.L. 86-272 (passed in 1959, when “software” meant punch cards) that protects businesses from state income tax if they’re only “soliciting orders” for tangible goods. For decades, this gave mail-order and e-commerce companies selling physical products a degree of protection.

The catch? This protection does NOT apply to:

- SaaS subscriptions

- Software licenses

- Consulting services

- Digital products

- Any service-based revenue

In other words: the entire modern tech economy.

What This Means in Practice

| Business Type | P.L. 86-272 Protection | Exposure Level |

|---|---|---|

| Selling physical products (shipped from out of state) | May be protected from income tax | Lower |

| SaaS / Subscription software | No protection | High |

| Digital downloads | No protection | High |

| Consulting / Professional services | No protection | High |

| Hybrid (products + services) | Partial—services portion exposed | Medium-High |

Bottom line: If you’re running a SaaS company, you get zero protection from the old “solicitation only” safe harbor. States can come after you for income tax based purely on where your customers are located.

The Remote Work Trap

Remote-first is the default for most SaaS companies now. It’s great for hiring the best talent regardless of location. But it comes with a tax twist that surprises many founders:

You’re based in Louisiana. You hire a developer who works remotely from California. Congratulations—you may now have nexus in California for:

- State income tax

- Payroll withholding

- Potentially sales tax

Remote Workers Can Create Nexus Through:

- Physical presence — Their home office counts as your business presence

- Payroll — You’re paying someone in that state

- Property — Their company laptop is “property” in that state

What To Do

- Track where all your employees and contractors work from (yes, even that contractor you hired on Upwork)

- Understand that “temporary” remote work may not create nexus, but regular/ongoing work likely does

- Consider the tax implications before approving remote work requests from new states

- If you’re a solo founder, your own location matters—where you work from is where your company has presence

The 5 Things Every Tech Entrepreneur Must Know

1. The $100K Threshold is Per State, Per Year

If you hit $100K in sales in California, you have nexus in California. Hit it in Texas too? Now you have nexus in two states. This can snowball fast for growing SaaS companies.

2. Sales Tax and Income Tax Nexus Are Different

You might trigger sales tax nexus but not income tax nexus (or vice versa). They have different rules and thresholds. Don’t assume one means the other.

3. SaaS Taxability Varies by State

Even if you have sales tax nexus, whether your SaaS product is actually taxable varies wildly:

| State | SaaS Taxable? |

|---|---|

| Texas | Yes |

| California | Generally No |

| New York | Yes |

| Florida | Yes |

| Washington | Yes (B&O tax) |

You need to check each state where you have nexus.

4. “I Didn’t Know” Isn’t a Defense

States have gotten aggressive about enforcement. They share data, they have sophisticated detection methods, and they’re hungry for revenue. Ignorance won’t protect you from back taxes and penalties.

5. Marketplaces May (or May Not) Handle It

If you sell through a marketplace (like AWS Marketplace, Shopify App Store, etc.), they might handle sales tax collection for you. But this doesn’t cover income tax nexus, and you still need to understand your obligations.

Practical Steps to Take Today

Step 1: Know Where Your Customers Are

Pull a report of sales by state. Identify any states where you’re approaching or exceeding $100K in annual revenue.

Step 2: Know Where Your People Are

Document where every employee and regular contractor works from. This is your physical nexus footprint.

Step 3: Prioritize High-Risk States

Focus first on:

- States where you clearly exceed thresholds

- States with aggressive enforcement (California, New York, Texas)

- States where you have any physical presence (people, property, offices)

Step 4: Understand Your Product’s Taxability

Research whether your specific product/service is taxable in each nexus state. SaaS taxability is a moving target—many states are adding it.

Step 5: Consider Voluntary Disclosure

If you discover you should have been collecting/paying taxes in a state, many states offer voluntary disclosure agreements (VDA) that can:

- Limit look-back periods (typically 3-4 years instead of unlimited)

- Waive or reduce penalties

- Allow you to come into compliance without an audit

The Multistate Tax Commission (MTC) offers a program to approach multiple states at once anonymously.

Step 6: Automate What You Can

The compliance burden of multi-state taxation has spawned an entire industry of automation tools. Here’s how they stack up for SaaS companies:

Tools That Can Help: A SaaS Founder’s Guide

Managing sales tax across 45+ states manually isn’t realistic for a growing company. Here’s the landscape of tools that can help:

Sales Tax Automation Platforms

Anrok — Built specifically for SaaS and subscription businesses. Understands the nuances of software taxability (which varies wildly by state). Integrates with Stripe, Chargebee, and other subscription billing platforms. Best for: Pure SaaS companies.

TaxJar — One of the original sales tax automation platforms, now owned by Stripe. Good all-around solution with strong reporting. Handles calculation, filing, and remittance. Best for: Companies selling mixed products/services.

Avalara — Enterprise-grade solution with the broadest coverage. More complex to implement but handles virtually any tax scenario. Best for: Larger companies or those with complex product mixes.

Stripe Tax — Native integration if you’re already on Stripe. Simple to enable, handles calculation and collection automatically. Best for: Early-stage companies already using Stripe who want minimal setup.

Newer Players Worth Watching

Numeral — Focuses on the full compliance lifecycle including registration, filing, and remittance. Takes a more hands-on approach to getting you compliant. Best for: Companies that need help with the entire process, not just calculation.

Kintsugi — AI-powered platform that handles nexus tracking, registration, and filing. Emphasizes automation of the entire workflow. Best for: Companies wanting maximum automation.

What These Tools Don’t Solve

- Income tax nexus — These platforms focus on sales tax, not state income tax obligations

- Nexus determination — They can track where you might have nexus, but the legal determination is yours

- Historical liability — If you’re already behind, you may need professional help with voluntary disclosure before implementing automation

- Product taxability research — They can tell you how much to charge, but determining whether your specific product is taxable often requires expert analysis

The Real Cost of “Doing It Later”

Many founders delay implementing tax automation because of the perceived cost ($50-500/month for most SaaS companies). But consider: a single state audit discovering 3+ years of uncollected sales tax can easily result in $50,000+ in back taxes, penalties, and interest—plus the professional fees to resolve it.

The math is simple: automation costs are a rounding error compared to the cost of non-compliance.

Common Mistakes to Avoid

| Mistake | Why It’s a Problem |

|---|---|

| “We’re too small to worry about this” | The $100K threshold isn’t that high for a growing SaaS company |

| “We only sell online, so we’re fine” | Online-only is exactly what Wayfair changed |

| “Our accountant handles taxes” | Many accountants aren’t state tax specialists—ask specifically |

| “We’ll deal with it when we’re bigger” | Back taxes compound. The longer you wait, the worse it gets |

| “We just won’t sell to [state]” | Not realistic for most businesses, and may not solve income tax nexus anyway |

What I Tell Every Founder I Work With

After years of helping companies build and scale software products, here’s my honest take:

Don’t let tax complexity paralyze you. I’ve seen founders so worried about getting nexus wrong that they delay launching or artificially limit their growth. That’s the wrong approach. The goal isn’t perfection from day one—it’s building systems that scale with you.

Budget for compliance early. When I help companies plan their tech stack, I now include tax automation in the “infrastructure” conversation alongside hosting, monitoring, and security. It’s not optional overhead—it’s a cost of doing business in a multi-state economy.

Your accountant might not know this stuff. Most general accountants are great at income taxes and bookkeeping. SALT (State and Local Tax) is a specialty. If your accountant’s eyes glaze over when you ask about nexus, find someone who specializes in it—at least for an initial assessment.

The $100K threshold sounds high until it isn’t. If you’re charging $99/month and have 85 customers in California, you’ve already crossed the threshold. That’s not a lot of customers for a growing SaaS.

Key Takeaways

-

Economic nexus is real — Selling $100K+ into a state means you probably have tax obligations there, regardless of physical presence.

-

SaaS gets no federal protection — P.L. 86-272 doesn’t help software and service companies. You’re exposed to state income tax based on where your customers are.

-

Remote workers create nexus — Every state where you have employees working is a state where you likely have tax obligations.

-

Sales tax ≠ Income tax — These are separate analyses with different rules. You need to understand both.

-

Proactive beats reactive — Voluntary disclosure is almost always better than waiting to get caught.

-

The AI boom makes this urgent — If you can build faster, you can scale faster—which means you can hit nexus thresholds faster than founders could five years ago.

Resources

- AICPA 2025 State Tax Nexus Guide — The definitive practitioner reference on nexus rules (much of the legal framework in this article is informed by AICPA research)

- AICPA SALT Roadmap — State-by-state nexus thresholds and requirements

- Multistate Tax Commission (MTC) — Voluntary disclosure programs (nexus@mtc.gov)

- Sales Tax Institute State Guides — State-by-state sales tax rates and rules

- Your State’s Department of Revenue — Most have online nexus questionnaires

- A qualified SALT (State and Local Tax) professional — Worth the investment once you’re scaling; general accountants often aren’t specialists in this area

Final Thought

State tax compliance isn’t the most exciting part of building a business, but it’s one of those “pay now or pay much more later” situations. A few hours of research today can save you tens of thousands in back taxes, penalties, and professional fees down the road.

The best time to understand your nexus exposure was before you launched. The second best time is today.

This article is for informational purposes only and does not constitute tax or legal advice. Consult with a qualified tax professional for guidance specific to your situation.

About the Author

Camilo Martinez is a fractional CTO who helps startups and growing businesses build software products. Having worked with dozens of SaaS companies—from early-stage startups to scaling enterprises—he’s seen firsthand how tax compliance surprises can derail otherwise healthy businesses. This guide comes from watching too many founders learn these lessons the hard way. Connect with Camilo at somniotech.com to discuss your technology strategy.